Why Your Pet’s Age Matters in Pet Insurance Plans

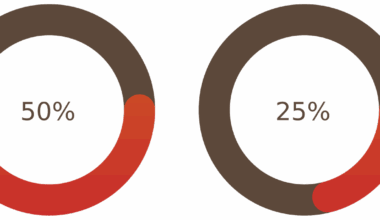

Understanding the impact of your pet’s age on insurance is essential. As pets age, they may face a range of health issues. Insurance companies frequently base their premiums on risk factors including age. Younger pets typically have fewer health problems, leading to lower premiums. Conversely, older pets are more susceptible to illnesses which can raise the costs significantly. Pet insurance policies often have age limitations and may impose stricter conditions for older pets. This can lead to higher out-of-pocket costs for owners. It’s crucial to review policies as pets age to ensure adequate coverage. Comparing different plans can help identify the best options. For pet owners, knowing the long-term costs is essential for financial planning. Additionally, pre-existing conditions can impact insurance eligibility. If a pet shows symptoms, securing insurance might become more difficult. This emphasizes the need to purchase coverage early. Moreover, the costs associated with treatments increase with age. Emergency care and surgery can be expensive, making insurance beneficial. Pet owners should educate themselves about policy details to avoid surprises later. Taking action sooner rather than later can protect pets and finances effectively.

The age of a pet can profoundly affect insurance coverage options. Insurers often categorize pets based on age groups. Typically, pets are considered seniors around the age of seven. Senior pets might experience serious health challenges that younger animals do not face. Consequently, premiums can increase significantly due to this categorization. Notably, these higher premiums reflect the increased risk of illnesses and emergency visits. For owners, it’s crucial to understand these changes. Furthermore, some insurance companies might refuse coverage altogether for older pets. Therefore, researching different providers can yield better options. Another factor influencing policies is breed-specific issues. Certain breeds are predisposed to genetic conditions that can emerge as pets age. It’s wise for owners to consider these factors while selecting a plan. Furthermore, it’s critical to maintain regular veterinary care for aging pets. Early detection of issues often leads to better outcomes. Insurers may offer benefits like routine care rider options for older pets. This can help owners manage costs associated with recurring visits or medications. Therefore, reviewing and understanding coverage details is vital, ensuring pets receive necessary care as they age.

As pets approach their senior years, wellness checks become vital. Regular check-ups can prevent health issues that arise with age. Pet insurance plans often include preventative care options to assist with these visits. For aging pets, incorporating dental care into insurance is essential. Oral health impacts overall wellness and should not be overlooked. Additionally, chronic conditions can develop over time, affecting insurance affordability. Insurance providers assess these factors when determining policy approval and coverage details. Familiarizing yourself with exclusions in your plan can save future headaches. A sound understanding of waiting periods can also be beneficial for owners. Policies may have waiting periods before coverage kicks in for specific conditions. For instance, waiting periods might affect how quickly you can claim benefits for an illness. This can be crucial if your pet develops health issues soon after enrollment. Therefore, reviewing your plan’s terms helps manage expectations. Furthermore, some insurance companies might have lifetime limits on payouts. Ensuring your policy aligns with your pet’s long-term health needs can safeguard against unexpected costs. Researching multiple insurers ensures the best choices for various ages and individual needs.

Impact of Pre-existing Conditions

Age, coupled with pre-existing conditions, significantly influences pet insurance premiums. Insurance companies categorize pets by age and health while evaluating coverage options. Pets that show signs of health issues may have a difficult time securing insurance. Moreover, some insurers might deny coverage for pre-existing conditions altogether. For older pets, this adds a layer of complexity. Therefore, purchasing insurance at a younger age can be beneficial. This proactive approach can prevent issues when seeking coverage later on. Pet owners need to gather detailed medical histories to provide insurers. A thorough history aids in clarification and may help minimize complications during the application process. Emphasizing preventive care and routine visits is also critical for older pets. Regular vet check-ups can lead to early diagnosis and management of chronic health conditions. It’s essential for owners to understand insurers’ definitions of pre-existing conditions as they vary. Ensuring clarity will help avoid unpleasant surprises later. Additionally, examining options for bundled plans can be advantageous. These often combine multiple types of coverage that can address your aging pet’s diverse health needs.

Choosing the right pet insurance significantly influences long-term outcomes. Research shows higher costs arise as pets age due to increased health needs. However, early enrollment can lead to affordable premiums and comprehensive coverage. Understanding the differences between accident-only and comprehensive policies is crucial. Comprehensive policies often cover a broader range of health-related expenses including surgeries, illnesses, and more. This type of coverage becomes exceptionally beneficial as pets age. Owners should also be aware of high deductibles that could impact out-of-pocket expenses. Balancing premium costs against deductible amounts is essential for optimal financial planning. Furthermore, many policies offer flexibility in choosing veterinarians. This becomes crucial as pets require specialized care. Access to a network of specialists ensures timely treatment as pets encounter health challenges. Familiarizing yourself with claim processes saves frustration later. Generally, insurers require specific documentation to process claims efficiently. Proactive tracking of medical expenses will aid in smooth claims management. Additionally, verifying if the policy remains valid after reaching a certain age is essential. Knowing your plan’s stipulations helps answer key questions about your aging pet’s future insurance needs.

Long-term Benefits of Insuring Aging Pets

Investing in pet insurance as your pet ages yields vital long-term benefits. As healthcare for pets advances, medical emergencies can be significantly costly. The peace of mind derived from having coverage can ease financial burdens. Furthermore, expenses related to chronic diseases can escalate quickly. Insurance allows you to focus on your pet’s health rather than overwhelming costs. Understanding policy specifics, such as annual maximums and limits, is crucial. This knowledge enables you to advocate effectively for your pet’s care. Additionally, many insurers provide options for reimbursements. Pet owners can select plans that minimize financial risks while still offering robust coverage. Moreover, insuring older pets ensures that necessary treatments are accessible. Treatments not covered by insurance can sometimes lead to financial strain. Thus, planning for future health needs is wise. Every pet deserves high-quality healthcare regardless of their age. Therefore, carefully considering policies is imperative. Pet insurance enables better financial management, ensuring pets receive the best care possible. Furthermore, educating yourself on policy variations may uncover additional savings on insurance. Being informed better prepares owners for potential health challenges as pets age.

Ultimately, pets require different levels of care as they age. Owners should continuously evaluate their insurance options in response to their pet’s changing needs. Regular assessments of coverage can lead to better protection. Compare policies with a focus on cost versus benefits to get accurate insights. In addition, understanding your rights as a policyholder helps maximize benefits. Be proactive in discussing changes in your pet’s health with your insurer to maintain coverage. Furthermore, engaging with your veterinarian for recommendations on insurance can prove helpful. Veterinarians can often provide insights into what coverages may be essential. Furthermore, they might suggest insurers known for excellent service during claims. The pet insurance landscape offers a variety of options tailored to different needs. Remember to assess both costs and services offered. As pets age, being informed contributes to better care. The responsibility of ownership extends to ensuring adequate medical coverage. Identifying the right policy can have long-lasting impacts on your pet’s life. Therefore, awareness about the insurance market becomes vital for responsible pet ownership.